摘要:通货膨胀率是一个重要的经济指标,其理解和管理对于经济稳定和持续发展至关重要。本文将探讨通货膨胀率的概念、影响因素及其对经济和消费者生活的影响。还将介绍如何有效管理通货膨胀,包括政策制定者的策略和消费者的应对措施。理解通货膨胀有助于我们更好地应对经济挑战,促进经济繁荣和社会福祉。

Inflation Rate – A Closer Look into Its Effects and Management Strategies

Sub-title: What is Inflation Rate, and How Does It Affect Our Daily Lives?

In today’s economic landscape, the term “inflation rate” is often heard, yet its true implications and underlying mechanisms are often misunderstood or overlooked by the general public. This article seeks to delve deeper into the concept of inflation rate, its impact on our daily lives, and how it can be managed to ensure economic stability.

What is Inflation Rate?

Inflation rate is a measure of the rate of decline in the purchasing power of a currency over a period of time. In simpler terms, it reflects the increase in prices of goods and services within an economy. When the inflation rate rises, it means that the cost of living increases, and people tend to have less purchasing power with their money. Conversely, a negative inflation rate, or deflation, indicates a decrease in prices, which means consumers can buy more with the same amount of money.

How Does Inflation Rate Affect Our Daily Lives?

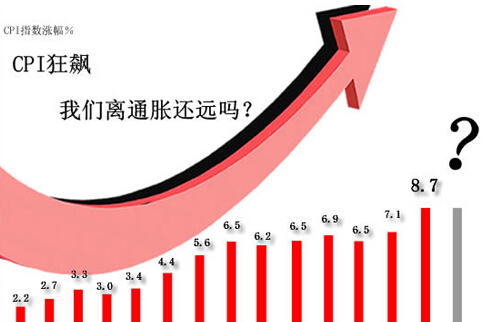

The inflation rate has a direct impact on people’s livelihoods. As prices of essential goods and services rise, people may find it harder to maintain their standard of living. For instance, a rise in food prices can lead to increased living costs, affecting low-income families more significantly. Similarly, higher education costs can burden families further, especially those with children who are still young and require significant financial investments.

Moreover, inflation can affect people’s financial decisions and investments. When inflation is high, investors may seek higher returns to offset the impact of price increases on their investments. This could lead to increased risks in investment strategies as investors look to capitalize on opportunities that offer higher yields.

What Are The Causes of Inflation?

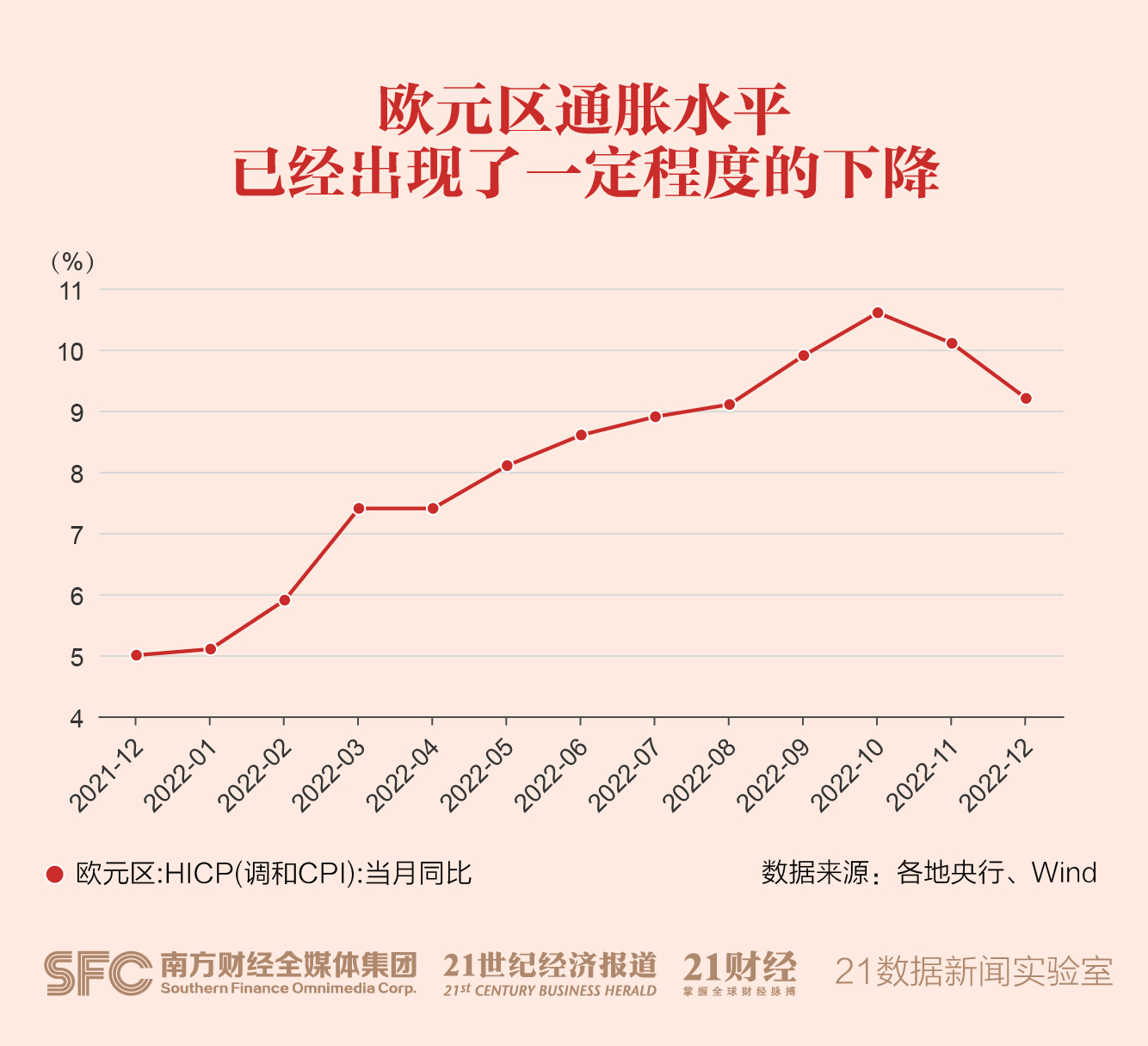

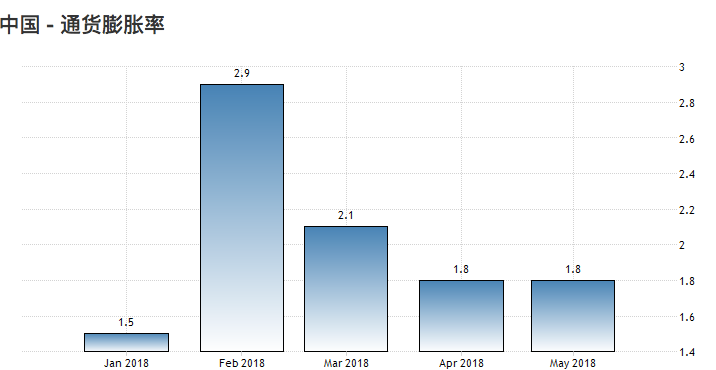

There are several factors that contribute to inflation, including supply chain disruptions, increased labor costs, rising production costs due to resource scarcity, and excessive money supply chasing too few goods. Understanding these factors helps policy makers and governments devise strategies to manage inflation effectively.

How Is Inflation Rate Managed?

Governments and central banks play crucial roles in managing inflation. By adjusting interest rates and controlling money supply, they can influence the economy’s demand and supply balance. For instance, when inflation is high, central banks may raise interest rates to reduce money supply in the economy, thereby cooling down price pressures. Conversely, when inflation is low or negative, they may cut interest rates to stimulate economic growth and encourage spending.

FAQs about Inflation Rate:

Q1: How can I protect myself from the impact of inflation?

A1: Diversifying your investments is one way to mitigate the impact of inflation. Investing in assets that can grow with inflation, such as stocks or real estate, can help offset the decline in purchasing power caused by inflation. Additionally, saving in cash equivalents like bank deposits or bonds can provide a cushion against rising prices.

Q2: What is the ideal inflation rate?

A2: The ideal inflation rate varies from economy to economy and depends on various factors like economic growth, productivity levels, and supply chain efficiency. Generally, most economists consider low and stable inflation as ideal for sustainable economic growth.

Q3: How does inflation affect savings?

A3: Inflation can erode the value of savings if they are not invested or managed properly. As prices rise, the purchasing power of fixed deposits or savings accounts may decline due to the erosion of purchasing power caused by inflation. Investing in assets that can grow with inflation can help protect your savings from the impact of inflation.

In conclusion, understanding the inflation rate is crucial for individuals and businesses to make informed financial decisions and investment strategies. By understanding its impact on our daily lives and how it can be managed effectively, we can navigate through inflationary pressures and ensure economic stability for ourselves and our families.

浙ICP备14032885号-5

浙ICP备14032885号-5